2026 Hollis Brookline Taxpayer

Information (updated

Feb. 28, 2026)

Brookline

Conservatives Election Day Voter Guide (pdf)

Hollis

Conservatives Co-Op Election Day Voter Guide (pdf)

Hollis

GOP 2026 Voter Guide (pdf)

SAU

41 Achievement and District Spending Presentation (pdf)

(Hollis GOP Webinar held Feb. 26, 2026)

SDGA

Special Education and SAU Consolidation Presentation (pdf)

(SDGA Webinar held Feb. 24, 2026)

2026

HB Co-Op Charter Commission Question for All Day Ballot

Voting on Warrant Articles (on March 10 ballot) (pdf)

2026 Brookline Town Petition Warrant Article Information

Papers

Are you concerned about your

property taxes in Brookline or Hollis? Support our

citizen petition warrant articles in 2026 to rein in

spending by adopting a local tax cap and/or budget cap,

require transparency on tax impact and candidate's party,

and adopt all day/absentee ballot voting. Mark your calendars to vote and attend

important annual meetings! A

few warrant articles are decided by ballot voting on

Mar. 10, 2026, but most warrant articles are decided

at the in-person town meeting on March 14 and school

meetings (Feb. 4 and March 19). Mark your calendars to attend!

Voter's Guides will be published here

as the meetings and balloting approach.

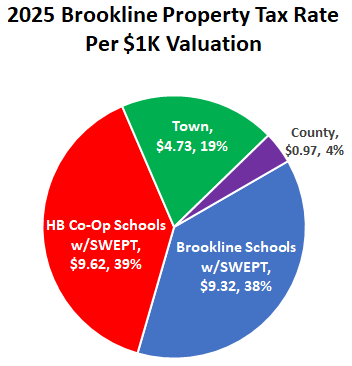

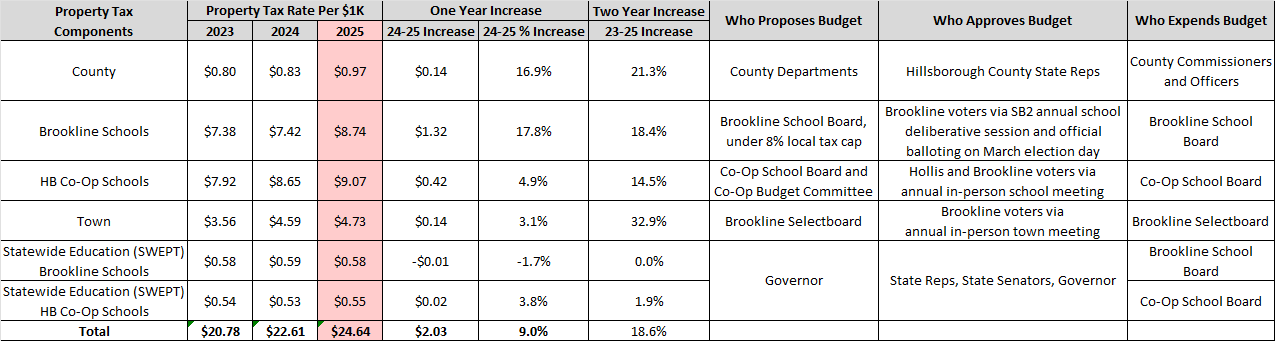

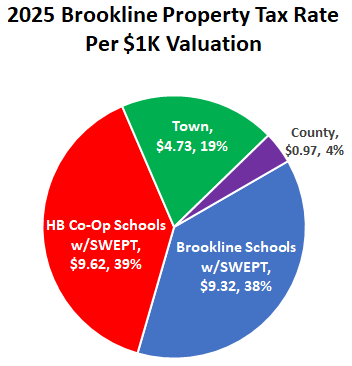

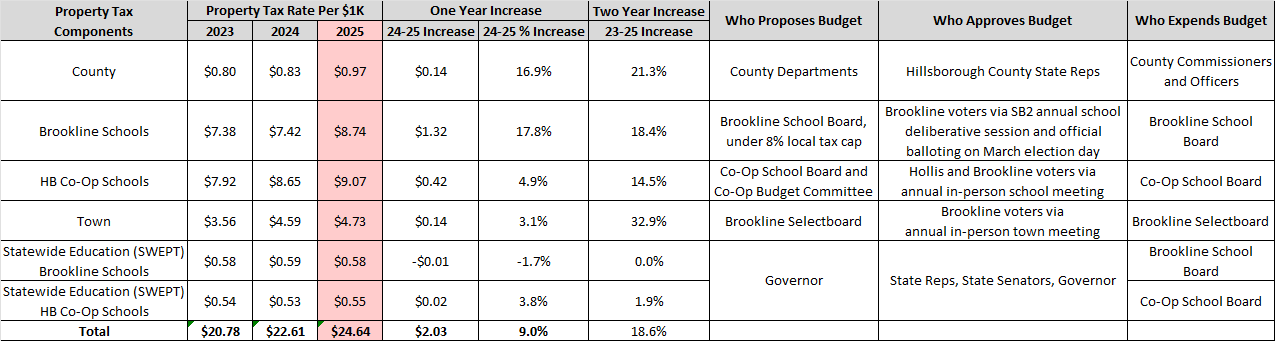

2025 Brookline Property Tax Rate - $24.64/1K (increase of

$2.03/1K, +9.0%) (Tax

rate history)

In past two years (2023 to 2025), Brookline Property Tax

Rate is up +$3.86/1K (18.6%).

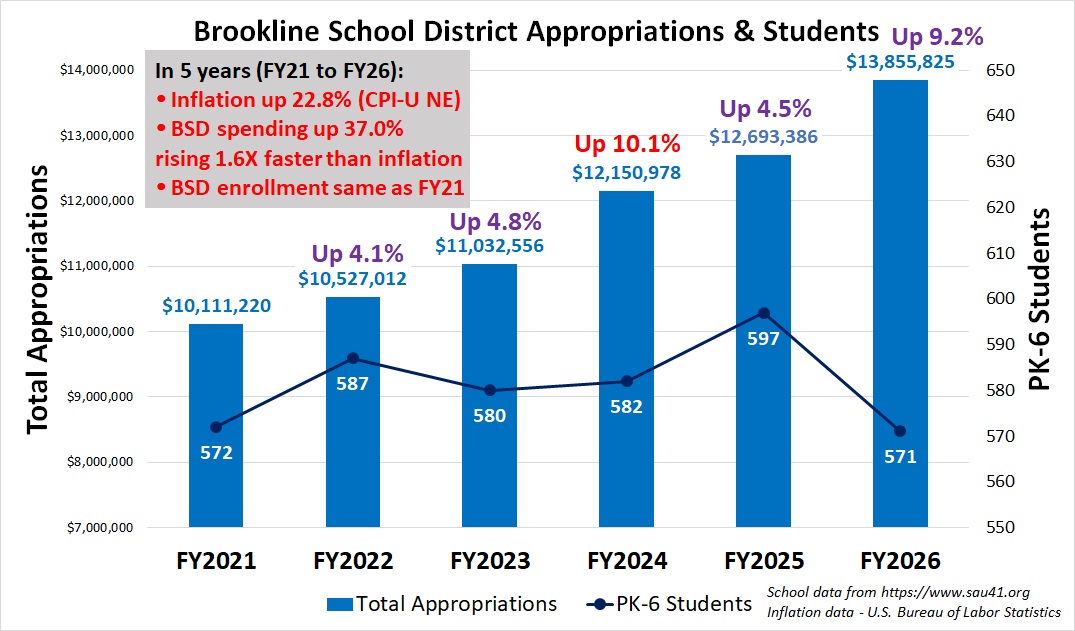

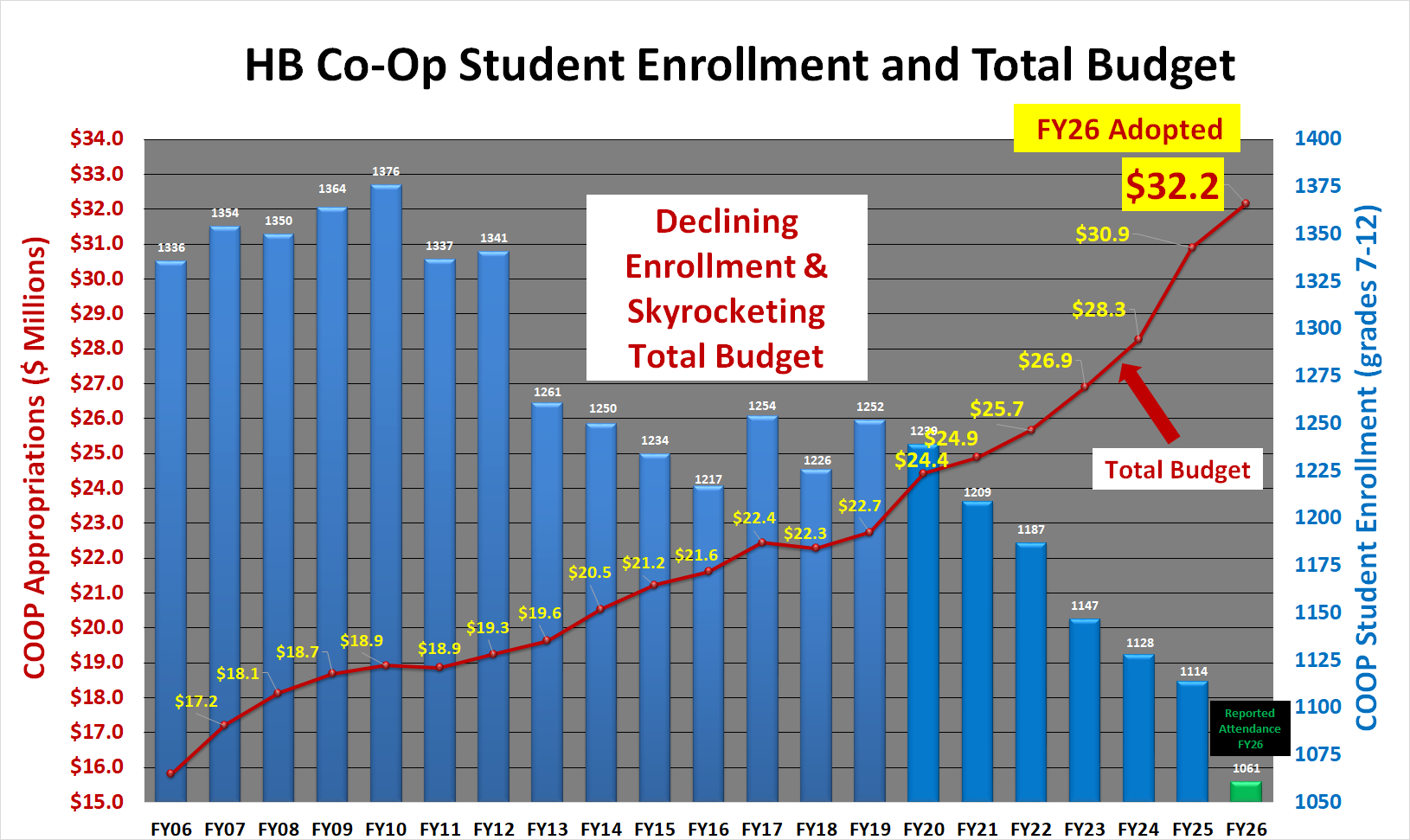

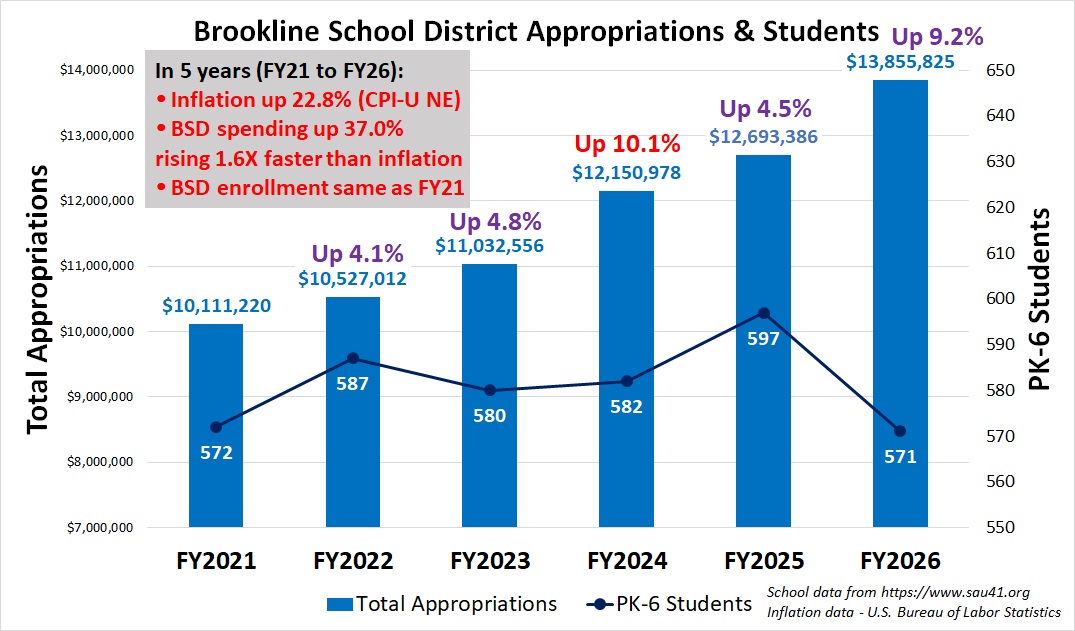

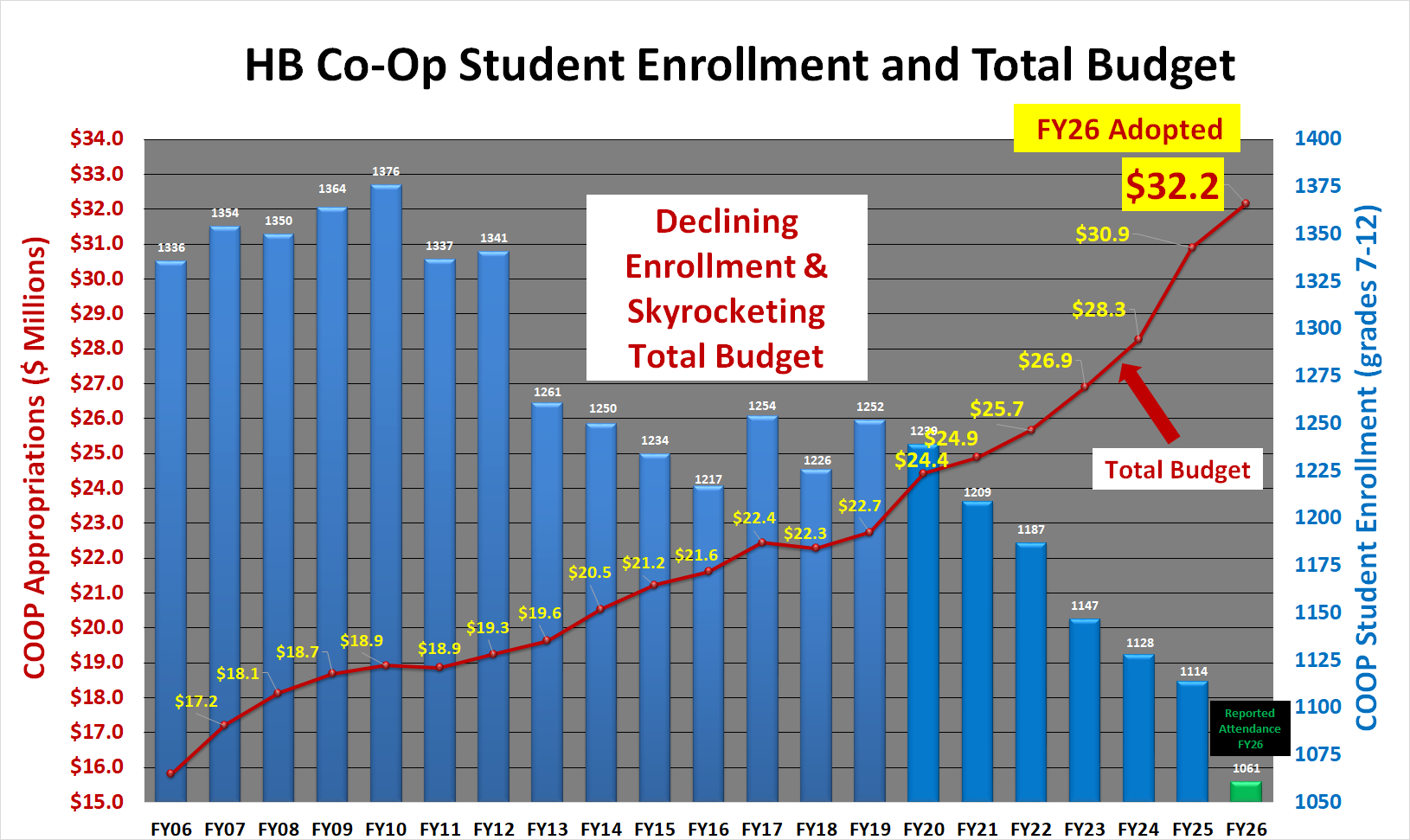

Graphs below show drivers of property tax increase. We have an unsustainable spending trend in our Brookline School District (BSD), Town of Brookline, and Hollis Brookline Co-Op School District, especially with declining student enrollments. We now spend $26,392/student (BSD) and $30,314/student (Co-Op).

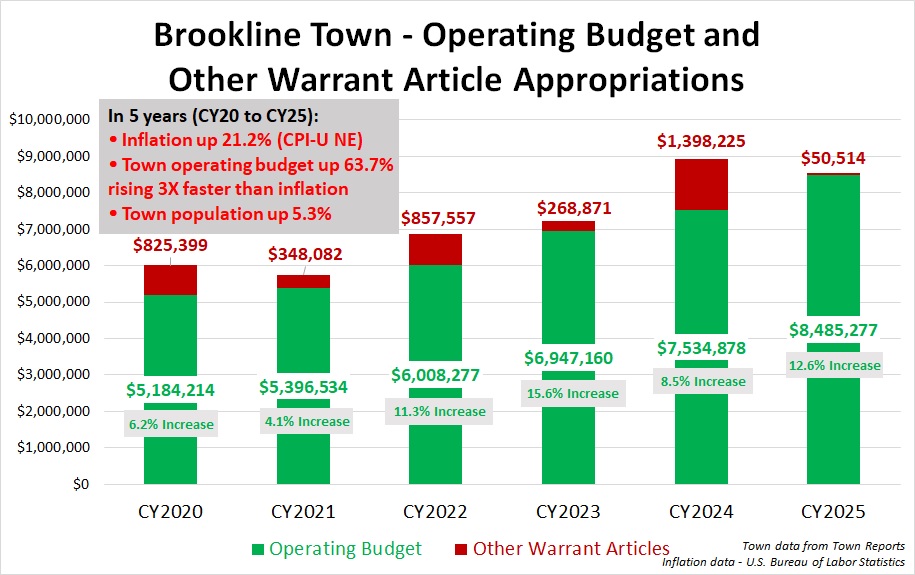

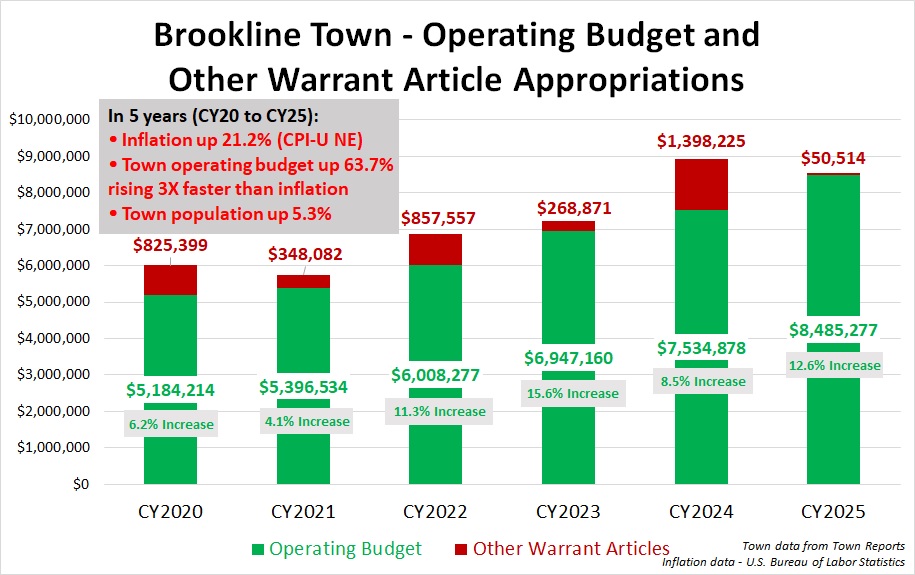

Brookline Town Operating Budget: $950,399 increase (12.6%) since last year.

Town operating budget has been increasing at 3X the rate of inflation since 2020.

Hollis Brookline Co-Op School District: $1,263,963 total spending increase (4.1%) since last year, with 4.8% fewer students.

This 4.1% increase is on top of 9.4% increase the previous year.

Total Co-Op spending per student up 9.3% in one year! ($30,314, up from $27,737)

FY25: 10.1 students per teacher (1114 students, 109.8 teachers)

NH average: 10.5 students per teacher; National average: 15.0 students per teacher

NH State Education Aid (Adequacy Aid) for Brookline students (BSD and Co-Op) is based on enrollment (NH Department of Education).

For SAU 41 (Hollis, Brookline, Co-Op), Concord has increased the state education aid per student faster than inflation over past 20 years!

State education aid to SAU 41 school districts has increased 71.6% in 20 years, exceeding inflation (CPI-U) of 63.7% -- this is not "down shifting".

Most residents do not consider these tax increases to be reasonable or sustainable. However, we the voters hold the power over the property tax rates, if we participate in local town and school meetings.

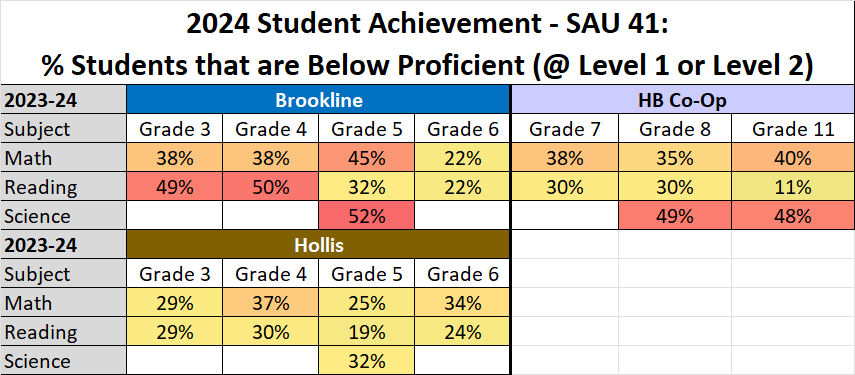

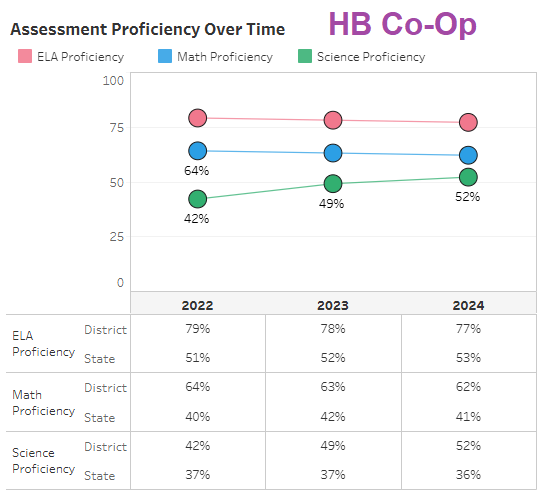

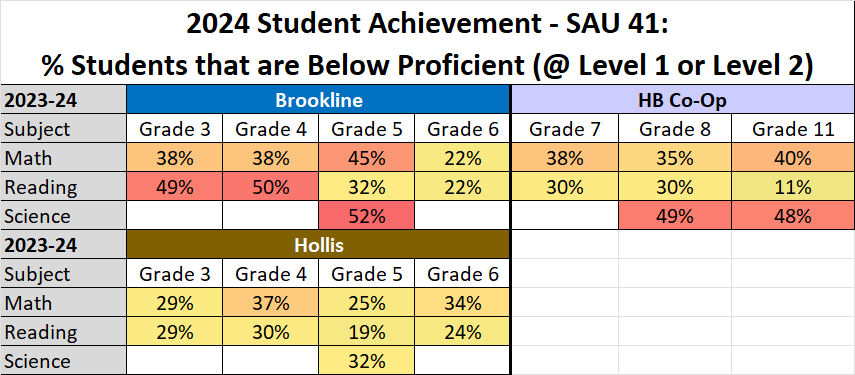

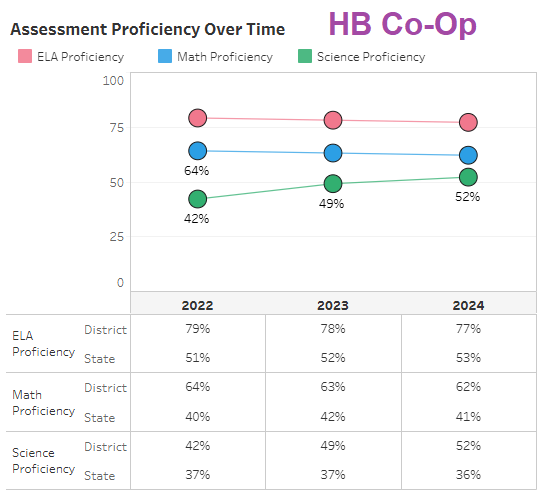

Many residents are concerned about our students not reaching proficiency in our schools. In many grades, we have 30%, 40%, 50% , or 60% of students who are not proficient in math, reading, and/or science. The table below shows the number of students who are NOT proficient per the most recent statewide assessments. To the right is the HB Co-Op assessment proficiency over the past three years, which is overall declining. This is very concerning.

Data Links from NH Dept of Education:

https://www.education.nh.gov/who-we-are/division-of-educator-and-analytic-resources/bureau-of-education-statistics/assessment-data

https://jwt.nh.gov/?src_route=iReport/Overview&debug_session=false&toolbar=Hidden&Width=1300px&Height=1600px¶meters=%7BSearch%20for%20School%20or%20District%20Name%20(Master)=Hollis-Brookline%20Cooperative%20(District);School%20or%20District=2;Entity%20ID%20of%20District%20Selected=260;Select%20Year=2025%7D

Organizer - Eric Pauer, info@hollisbrookline.com

Last Updated February 28,

2026

Brookline

Conservatives Election Day Voter Guide (pdf)

for March 10, 2026 Town/School Election (updated

Feb. 28, 2026)

Hollis

Conservatives Co-Op Election Day Voter Guide (pdf)

for March 10, 2026 Town/School Election (updated

Feb. 27, 2026)

Hollis

GOP 2026 Voter Guide (pdf)

for March 10, 2026 Town/School Election,

Town Meeting, Hollis and Co-Op School Meetings (updated Feb. 27, 2026)

SAU

41 Achievement and District Spending Presentation (pdf)

(Hollis GOP Webinar held Feb. 26, 2026)

SDGA

Special Education and SAU Consolidation Presentation (pdf)

(SDGA Webinar held Feb. 24, 2026)

2026

HB Co-Op Charter Commission Question for All Day Ballot

Voting on Warrant Articles (on March 10 ballot) (pdf)

2026 Brookline Town Petition Warrant Article Information

Papers

- Adopt Charter Commission to Propose All Day Ballot Voting on Warrant Articles (pdf)

- Adopt SB2

(Official Ballot Referenda) for Brookline (pdf)

- Adopt

Town Budget Cap for Brookline (pdf)

- Adopt Local Tax Cap for Brookline (pdf)

2026 Brookline School District Deliberative Session Conservatives Voters Guide (pdf) (meeting held Feb. 4, 2026)

Brookline - NESDEC

School Year 2025-26 Enrollment Projection Report

(11/3/2025)

Are you concerned about your

property taxes in Brookline or Hollis? Support our

citizen petition warrant articles in 2026 to rein in

spending by adopting a local tax cap and/or budget cap,

require transparency on tax impact and candidate's party,

and adopt all day/absentee ballot voting. Mark your calendars to vote and attend

important annual meetings! A

few warrant articles are decided by ballot voting on

Mar. 10, 2026, but most warrant articles are decided

at the in-person town meeting on March 14 and school

meetings (Feb. 4 and March 19). Mark your calendars to attend!

Voter's Guides will be published here

as the meetings and balloting approach.

- Brookline School District

- Adopt inflation and enrollment based local tax cap and/or school district budget (spending) cap

- Return all unexpended funds to

taxpayers for tax relief

- Deliberative

Session (Meeting) on Wednesday,

Feb. 4, 2026 - meeting complete.

- Ballot voting on Tuesday, Mar. 10, 2026, 7 am to 7:30 pm, CSDA

- Town of Brookline (Municipal)

- Adopt inflation and population based local tax cap and/or town district budget (spending) cap

- Adopt charter

commission to go to all day/absentee ballot voting

annually on all warrant articles

- Adopt SB2 for all day/absentee ballot voting

- Ballot voting on Tuesday, Mar. 10, 2026, 7 am to 7:30 pm, CSDA

- Town Meeting on Saturday, Mar. 14, 2026, time

TBD, CSDA

- Hollis Brookline

Cooperative School District

- Adopt inflation and enrollment based local tax cap and/or school district budget (spending) cap

- Adopt charter commission to go to all day/absentee ballot voting annually on all warrant articles

- Adoption SB2 for all day/absentee ballot voting

- Require tax impact to

Hollis and to Brookline to be listed in all warrant

articles

- Ballot voting on Tuesday, Mar. 10, 2026,

7 am to 7:30 pm, CSDA (Brookline

voters), Lawrence Barn 7 am to 7 pm

(Hollis voters)

- School

Meeting on Thursday, Mar.

19, 2026, 6:30 pm, HB High School

(snow day Mar. 20, 2026)

2025 Brookline Property Tax Rate - $24.64/1K (increase of

$2.03/1K, +9.0%) (Tax

rate history)

In past two years (2023 to 2025), Brookline Property Tax

Rate is up +$3.86/1K (18.6%).

Graphs below show drivers of property tax increase. We have an unsustainable spending trend in our Brookline School District (BSD), Town of Brookline, and Hollis Brookline Co-Op School District, especially with declining student enrollments. We now spend $26,392/student (BSD) and $30,314/student (Co-Op).

Brookline School District (BSD):

$750,231 total spending increase proposed (5.4%), on

top of last year's $1,162,439 total spending increase

(9.2%), with fewer students.

Total BSD spending per student up 23.3% in past three

years! ($26,653, up from $21,621)

FY25: 9.3 students per teacher (548 PK-12

students, 59 teachers)

NH average: 10.5 students per teacher;

National average: 15.0 students per teacher

Brookline Town Operating Budget: $950,399 increase (12.6%) since last year.

Town operating budget has been increasing at 3X the rate of inflation since 2020.

Hollis Brookline Co-Op School District: $1,263,963 total spending increase (4.1%) since last year, with 4.8% fewer students.

This 4.1% increase is on top of 9.4% increase the previous year.

Total Co-Op spending per student up 9.3% in one year! ($30,314, up from $27,737)

FY25: 10.1 students per teacher (1114 students, 109.8 teachers)

NH average: 10.5 students per teacher; National average: 15.0 students per teacher

NH State Education Aid (Adequacy Aid) for Brookline students (BSD and Co-Op) is based on enrollment (NH Department of Education).

- FY25 Adequacy Aid was $4,093/student for 1068.34 students ($4,372,983)

- FY26 Adequacy Aid is

$3,983/student, for 1043.35 students

($4,155,497), decrease of $110/student (-2.7%)

from FY25

- FY27 Adequacy Aid projected to be

$4,860/student, for 1016.47 students ($4,939,576),

increase of $877/student (22.0%) from FY26

For SAU 41 (Hollis, Brookline, Co-Op), Concord has increased the state education aid per student faster than inflation over past 20 years!

- FY06 education aid to SAU 41 School Districts: $1,837 per student ($4,720,054 for 2,570 SAU 41 students)

- FY26 education aid to SAU 41 School Districts: $3,152 per student ($7,219,854 for 2,291 SAU 41 students)

- Per NH Dept of Education (link)

State education aid to SAU 41 school districts has increased 71.6% in 20 years, exceeding inflation (CPI-U) of 63.7% -- this is not "down shifting".

Most residents do not consider these tax increases to be reasonable or sustainable. However, we the voters hold the power over the property tax rates, if we participate in local town and school meetings.

Many residents are concerned about our students not reaching proficiency in our schools. In many grades, we have 30%, 40%, 50% , or 60% of students who are not proficient in math, reading, and/or science. The table below shows the number of students who are NOT proficient per the most recent statewide assessments. To the right is the HB Co-Op assessment proficiency over the past three years, which is overall declining. This is very concerning.

Data Links from NH Dept of Education:

https://www.education.nh.gov/who-we-are/division-of-educator-and-analytic-resources/bureau-of-education-statistics/assessment-data

https://jwt.nh.gov/?src_route=iReport/Overview&debug_session=false&toolbar=Hidden&Width=1300px&Height=1600px¶meters=%7BSearch%20for%20School%20or%20District%20Name%20(Master)=Hollis-Brookline%20Cooperative%20(District);School%20or%20District=2;Entity%20ID%20of%20District%20Selected=260;Select%20Year=2025%7D

Organizer - Eric Pauer, info@hollisbrookline.com